Tesla Strikes $16.5 Billion Deal With Samsung to Build Next-Gen AI6 Chips — Powering Self-Driving Cars, Robots, and Data Centers

Why This Deal Matters

Samsung’s Texas Foundry Gets a Boost

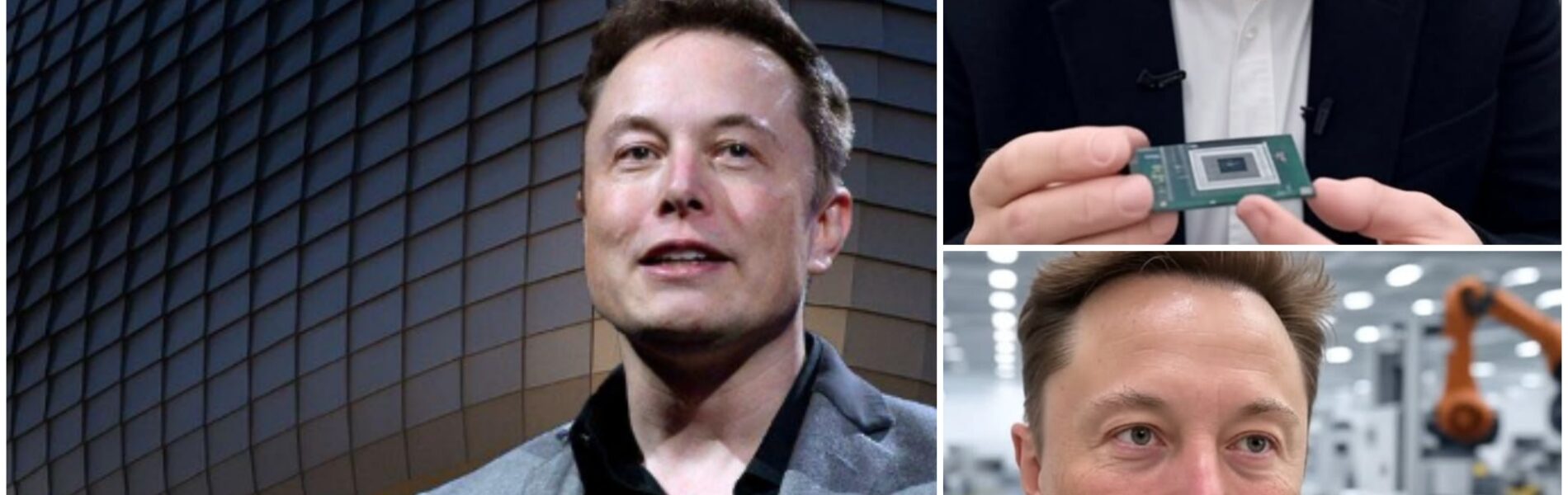

Musk’s Role in the Deal

The AI6 Processor: Tesla’s Secret Weapon

The Bigger Picture: Tesla Beyond Cars

Risks and Challenges